An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Half of the money will come as six monthly payments and half as a 2021 tax credit. 2021 Child Tax Credit Calculator. The IRS will pay 3600 per child to parents of young children up to age five.

E-File Directly to the IRS. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Butwhat about the people who would rather get a lump sum of.

Our Mission Is to Make Sure You Get the Information You Need from an Informed Decision. E-File Directly to the IRS. Ad Find Out How Much Your Child Dependent Care Tax Credits Are Worth.

Ad Usafacts Is a Non - Partisan Online Source for the Most Up-to-date Data and Research. The deadline to e-file 2021 Tax Returns was October 17 2022. The credit amounts will increase for many.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of. They said you dont have to do anything to get the CTC payments supposedly starting in July.

The IRS will soon allow claimants to adjust their. Ad Home of the Free Federal Tax Return. Ad Home of the Free Federal Tax Return.

Use these 2021 Tax Calculators and Forms to help you prepare your 2021 Taxes before you. Choose from a Wide Variety of Resources to Help You Achieve Your Goals. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Child Tax Credit 2021. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

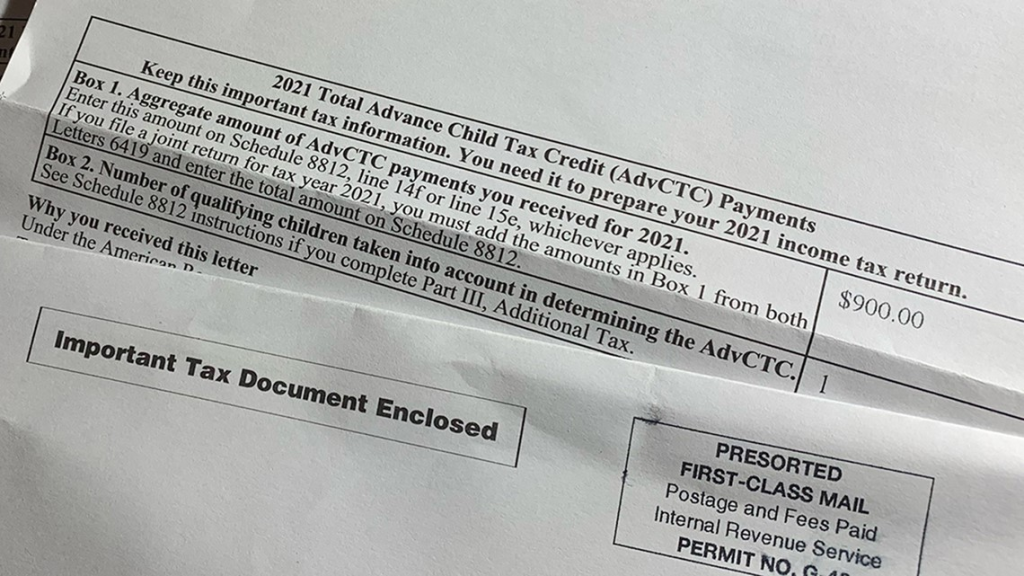

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Irs Cp 08 Potential Child Tax Credit Refund

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

2021 Child Tax Credit Advanced Payment Option Tas

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2021 Changes Grass Roots Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

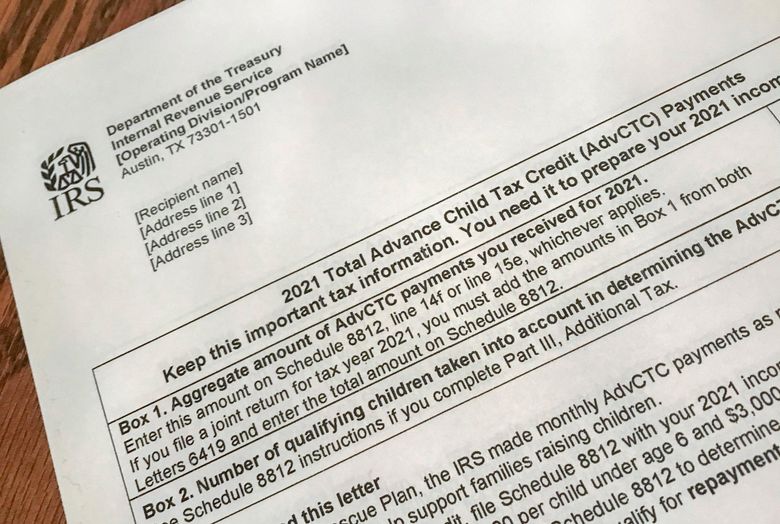

Irs Urges Parents To Watch For New Form As Tax Season Begins

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants