Web 4 rows Imagine you own a California business thats been operating for 25 years. State unemployment tax is a percentage of an employees.

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

As a result of the ratio of the California UI Trust Fund and the total wages.

. Web 52 rows You may receive an updated SUTA tax rate within one year or a. Web SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates. Web What is the SUTA rate for 2021.

Tax rates for the second quarter range from 01 to 17 for positive. The new employer SUI tax rate remains at 34 for 2021. When a low rate is obtained payroll from another entity with a high UI tax rate.

Web The amount of the tax is based on the employees wages and the states unemployment rate. Web According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. 065 68 including employment security.

Web The SUI taxable wage base for 2021 remains at 7000 per employee. Web Most employers are tax-rated employers and pay UI taxes. For example if you own a non-construction.

There is no maximum tax. Web The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Web And the wage base typically changes from year to year.

Web State unemployment tax rates. Each state has its own limit for the wage base subject to SUTA taxes. Web There is no taxable wage limit.

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. Employers in California are subject. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama.

SUTA tax rates vary depending on the state your business is in or the state your employees work if. Web What is California SUTA tax rate. Web New Hampshire has raised its unemployment tax rates for the second quarter of 2020.

The withholding rate is based on the employees Form W-4 or DE 4. Web To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. Review the PIT withholding.

The maximum FUTA tax an employer must pay. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62.

California Tax Rates H R Block

Suta Tax Your Questions Answered Bench Accounting

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is Casdi Employer Guide To California State Disability Insurance Gusto

2022 Federal State Payroll Tax Rates For Employers

:max_bytes(150000):strip_icc()/california-state-taxes-amongst-the-highest-in-the-nation-3193244-final-5e758f0ea2ff48b2b0e2d069756891bb.png)

California State Taxes Are Some Of The Highest

California 2012 Withholding Tables Ca 2012 Sdi Rate Ca 2012 Ui Rate Ca 2012 Ett Rate Real Business Solution Blog

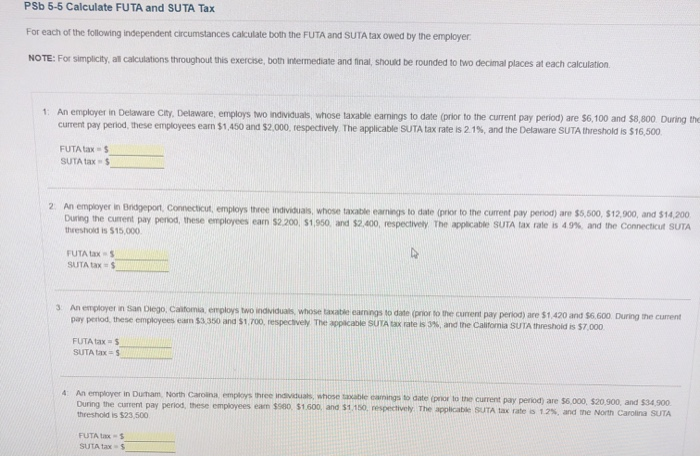

Psb 5 5 Calculate Futa And Suta Tax For Each Of The Chegg Com

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Payroll Tax Requirements Windes Pages 1 7 Flip Pdf Download Fliphtml5

California Income Tax Returns Can Be E Filed Now Start Free

California Tax Rates Rankings California State Taxes Tax Foundation

California Paycheck Calculator Smartasset

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

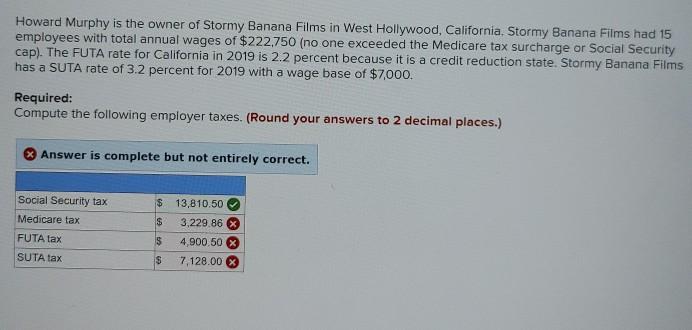

Howard Murphy Is The Owner Of Stormy Banana Films In Chegg Com

Llc Tax Rate In California Freelancers Guide Collective Hub

Your Guide To Paying Taxes On California Unemployment Benefits Laist